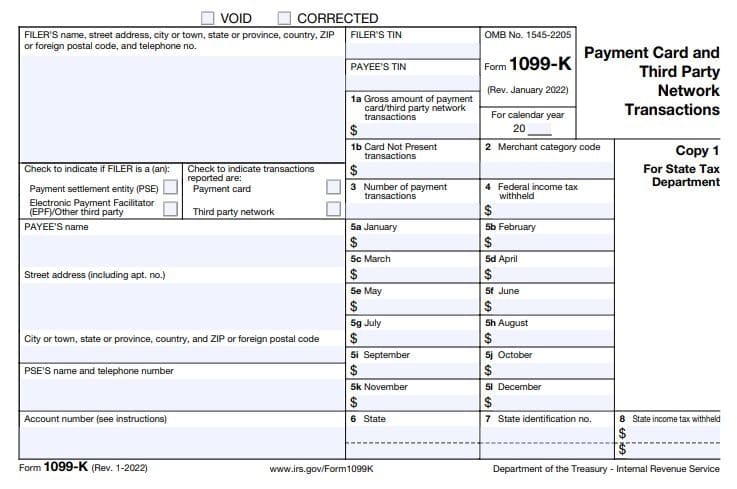

In 2021 and prior years, you would only receive this form if the gross amount was over $20,000 from over 200 transactions; starting in 2022, you will receive this form if the gross amount is over $600 no matter the number of transactions. The gross amount, shown in Box 1 of the form (see image below), is not adjusted by anything – such as credits or refunds – and does not differentiate between types of transactions – such as gifts or taxable income – so it is important that you keep records of your activities throughout the year. You need to have records that can prove not only what is taxable or non-taxable income, but you may also need to keep records that prove that you did not actually receive certain reported amounts.

First, let’s look at taxable versus non-taxable income shown on the 1099-K. An amount included on the form is only non-taxable under two situations: if it was truly a gift (given “as a result of detached and disinterested generosity”) such as through some crowdfunding events; or if it was received from the sale of personal property on which you incurred a loss (you sold something for less than it was worth). It is important to note a few issues that may create confusion. The sale of personal property that results in a gain for you (you receive more than the item was worth) are considered taxable income, and you cannot deduct the amount from a different sale that resulted in a loss from the total gain that you must report. If your employer makes a contribution to your crowdfunding on your behalf or in lieu of a portion of your regular income, that contribution will be considered by the IRS as part of your gross income from that employer; this means that attempting to avoid income taxes by having your employer crowdfund your life is not a viable option. In addition, amounts received by gig work, no matter the amount, are considered taxable income.

Second, let’s look at an amount that may be correctly attributed to your gross amount, but which should be adjusted off to reach the net taxable amount. This would include adjustments such as credits given, refunds given, or cash-back transactions that were processed.

Third, let’s look at amounts that may not be correctly attributed to you. There are many situations in which, at the end of the year, you may be the owner of a business or a terminal and so receive the 1099-K for the entire year, but you did not actually receive all of the money throughout the year. If you share a terminal with another person or business, then you must keep accurate records of your portion versus their portions. If you bought or sold a business, or if you had a change in the type of business such as to an S-corp where the income changes from an amount you personally report to an amount reported through the business, you must keep accurate records that reflect the amounts received not only before and after the event but also the transactions that occurred during the transition time. It is also important to keep accurate records if you run multiple businesses through one terminal, so that you can correctly report on each business entity.

To put it simply: keep solid records. If you receive money as a gift, document that you received a gift. If your employer, be it a regular employer or from a gig job, gives your money, record it as income. If you share a terminal, have any sort of business entity changes, or run more than one business, keep accurate records of what amounts are attributable to whom. And, if you have any questions, give us a call!